America’s Economic Balancing Act in 2025

America’s Economic Balancing Act in 2025: Growth, Inflation, and Uncertainty

The United States has long been seen as the engine of the global economy. Entering 2025, that engine is still running — but it’s navigating a more complicated road. America’s economy is showing signs of resilience and steady growth, yet inflation, shifting labor dynamics, and consumer debt raise real questions about its long-term direction.

In this article, we explore how the U.S. economy is balancing between growth and uncertainty in 2025, focusing on key indicators shaping the current climate.

For a deeper look into related topics, check out our detailed report on

U.S. Economy Outlook 2025.

—

1. Slow but Solid Economic Growth

After years of rapid recovery from the pandemic, the American economy is settling into a slower but healthier pace. According to recent Federal Reserve data, GDP growth is projected to hover around 1.8% in 2025.

While that may sound modest compared to previous years, economists argue this level of growth is sustainable. Instead of overheating, the economy now moves forward at a controlled rhythm — a sign of maturity rather than weakness.

Key Drivers of Growth Include:

Expansion in technology, particularly AI and green energy sectors.

Federal spending through the Infrastructure Investment and Jobs Act.

Steady consumer demand, especially in services like healthcare, travel, and dining.

—

2. Inflation: The Lingering Challenge

Even as growth stabilizes, inflation remains a central concern for both policymakers and everyday Americans. Prices for goods and services surged during 2022–2023, and while the worst may be over, costs remain stubbornly high in areas such as housing, groceries, and healthcare.

As of mid-2025:

Core inflation is approximately 3.2%, above the Federal Reserve’s 2% target.

Mortgage rates and other interest-related costs are still elevated due to the Fed’s ongoing tightening policies.

The Federal Reserve has kept interest rates higher than usual in its effort to control prices, but this has also increased borrowing costs for households and businesses alike. Homebuyers, for example, face significant challenges with mortgage affordability.

—

3. Labor Market Trends: Opportunities and Frictions

The U.S. job market remains relatively strong, with unemployment around 4.1%. This suggests near-full employment, but there are underlying frictions:

Wage Growth: Wages have risen faster than inflation in sectors like healthcare, hospitality, and logistics.

Labor Shortages: Industries such as construction and elder care continue struggling to fill positions, partly due to aging demographics.

Remote Work Culture: Hybrid and remote work arrangements have become the norm in many white-collar fields, permanently altering urban office demand and shifting real estate patterns.

These changes suggest that while jobs are available, the types of skills in demand are evolving rapidly.

—

4. Rising Consumer Debt: A Double-Edged Sword

American consumers have been known for their spending habits, fueling much of the country’s economic growth. However, 2025 brings a growing concern: record levels of consumer debt.

Credit card debt exceeded $1.2 trillion by early 2025, the highest in U.S. history.

Auto loans and student debts also contribute to household financial strain.

Despite these numbers, consumer spending hasn’t collapsed — but many households are adjusting by cutting back on non-essential items and focusing more on savings. This creates a mixed picture for retailers, where luxury brands report slowing sales while discount stores and essential goods see steady demand.

—

5. Global Influences: America Doesn’t Stand Alone

The U.S. economy is heavily impacted by international trends. Some of the most important external factors in 2025 include:

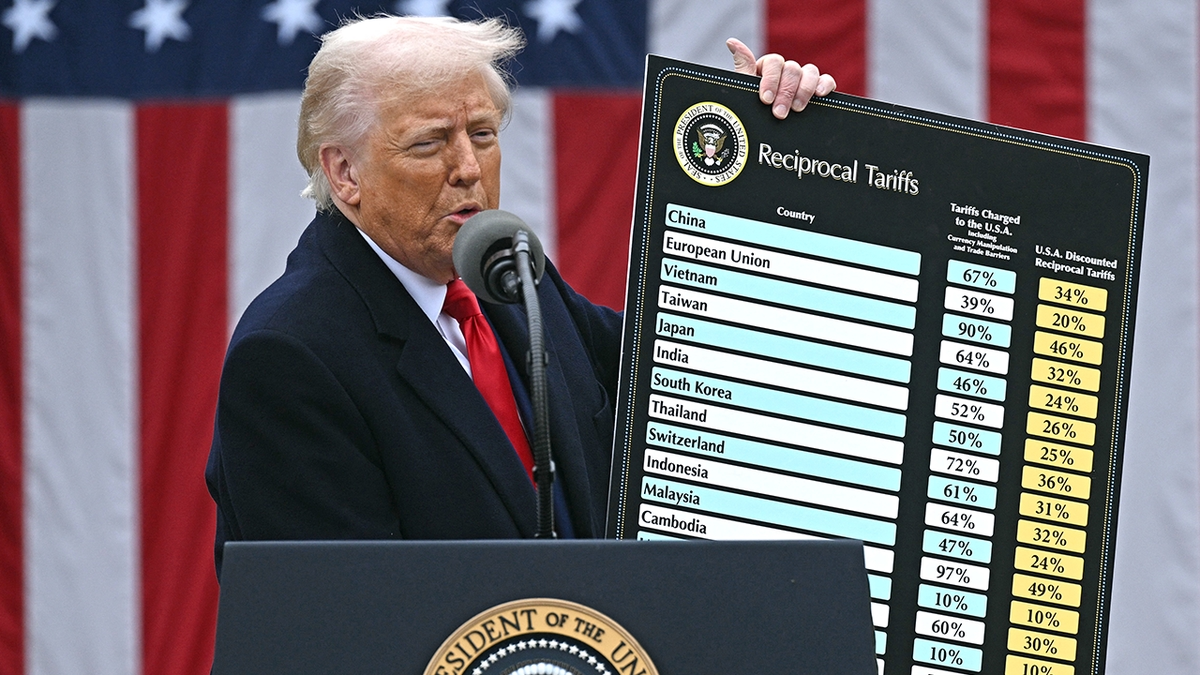

Trade with China: Ongoing negotiations over tariffs and technology regulations remain sensitive.

Global Oil Prices: While more stable than in previous years, energy markets react quickly to geopolitical tension.

Artificial Intelligence & Technology Competition: The U.S. competes with global rivals in developing AI systems, battery technologies, and renewable energy solutions.

—

Conclusion: A Delicate Balancing Act

In simple terms, the U.S. economy in 2025 feels like walking a tightrope. Growth is happening, but at a more cautious pace. Inflation is lower than during peak crisis years, yet still noticeable in everyday life. Job opportunities remain wide, but not all sectors are equally healthy. And household debt shadows any optimism.

What does this mean for the average American or business owner? Staying informed, adaptable, and cautious seems to be the winning strategy. Whether it’s adjusting investment portfolios, rethinking career paths, or simply budgeting more carefully, navigating America’s economic balancing act requires both patience and smart decisions.

https://www.bea.gov/news/2025/gross-domestic-product-1st-quarter-2025-advance-estimate

Share this content: